Your Self-Directed IRA + Your Traditional Assets = Simplicity & Convenience

ETC Brokerage is a simple path to combining traditional assets such as stocks, bonds and mutual funds with alternative investments within an Equity Trust self-directed account.

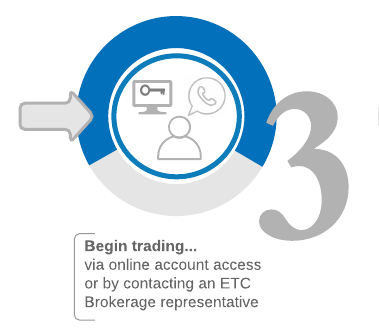

3-steps to Getting Started

1. ETC Brokerage offers stock, bond & mutual fund trading to existing Equity Trust Company clients through an ETC Brokerage account. The process to get started is simple. Once you have opened an Equity Trust Company account you can also establish an ETC Brokerage account. Begin trading with the available cash balance in your Equity Trust Company account or quickly fund your account by requesting an “in-kind” transfer of eligible publicly traded securities.

REGISTERED WITH THE SEC & A MEMBER OF SIPC AND FINRA

INVESTMENT PRODUCTS

Equity Trust Company clients can purchase the following public securities with an ETC Brokerage account:

Publicly Traded Stocks

Mutual Funds

Exchange Traded Funds (ETFs)

Fixed Income Securities:

Bonds, Treasuries, CDs

ETC Brokerage Services, LLC provides brokerage services to individual retirement and other custodial accounts for which its affiliate, Equity Trust Company, serves as custodian.

Getting Started

Discover the simple path to combining traditional assets with your alternative investments within an Equity Trust self-directed IRA

Funding your ETC Account: "In-kind" transfers...

Did you know that you may not have to liquidate your public investment holdings to fund your Equity Trust Company account?

ETC Brokerage Services provides you with the convenience of holding your publicly traded assets as well as offering stock, bond, & mutual fund trading, through an ETC Brokerage account. ETC Brokerage Services provides brokerage services to individual retirement and other custodial accounts for which its affiliate, Equity Trust Company, serves as custodian.

The process to transfer eligible publicly traded securities “in-kind” can be accomplished quickly and easily.

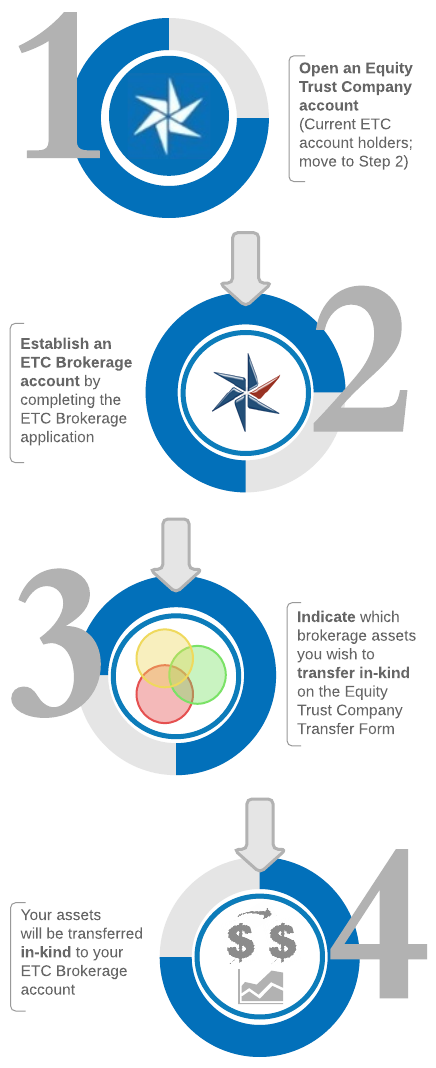

4 steps to transferring assets "in-kind"

First, open an Equity Trust Company account. Once your Equity Trust Company account is established, you can also open an ETC Brokerage account. To request your public investments be transferred “in-kind” to your ETC Brokerage account, complete the Equity Trust Transfer Form and list the positions you wish to transfer and select that you would like to transfer those positions “in-kind”.

Once Equity Trust Company receives your transfer form, ETC Brokerage will request the assets to be electronically transferred to your ETC Brokerage account. The total value of your brokerage account assets will be reflected within your Equity Trust Company account holdings. Detailed brokerage account information is available through ETC Brokerage online, and in brokerage account statements

Resources

Access our FAQs, Brokerage Fees, Form CRS & Additional Forms to get started

Get Started WIth an in-kind transfer: